Nvidia and Navitas Semiconductor Partnership: How a Major Collaboration in AI Infrastructure Came to Be

On May 21, 2025, Navitas Semiconductor (NASDAQ: NVTS) officially announced a strategic partnership with tech giant Nvidia (NASDAQ: NVDA), sparking significant interest among investors and market watchers. The collaboration aims to develop and supply critical components for next-generation AI data center power infrastructure—a field where Nvidia is a clear leader.

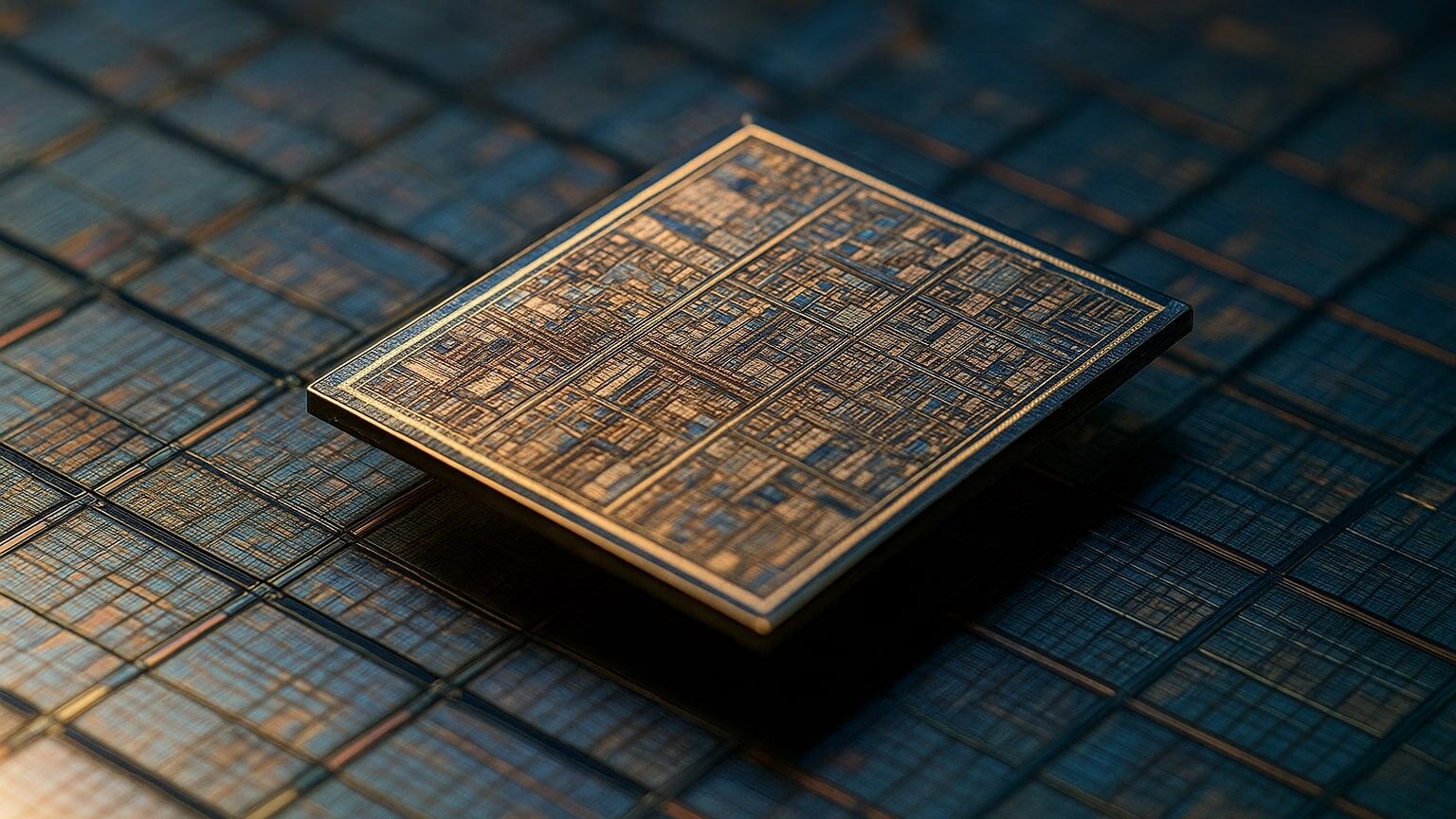

This partnership was triggered by Nvidia’s need to optimize the performance and energy efficiency of its upcoming Kyber rack-scale systems, designed to power ultra-high-performance GPUs like the Rubin Ultra. Nvidia sought a specialized partner in cutting-edge semiconductor technology to meet the high voltage and efficiency demands. They turned to Navitas Semiconductor, a smaller but innovative company known for its advanced GaN (gallium nitride) power solutions, which provide more efficient and compact power conversion than traditional silicon-based technologies.

Navitas will supply its GaNFast™ and GeneSiC™ chips to significantly reduce copper usage and boost the efficiency of Nvidia’s systems. This deal not only supports the expansion of AI infrastructure but also positions Navitas as a crucial player in the technology ecosystem dominated by major tech corporations.

Why Navitas Semiconductor Was Chosen and the Significance of 800V HVDC Technology

Navitas Semiconductor’s selection as a partner by Nvidia is no coincidence — it’s a recognition of their breakthrough technology in gallium nitride (GaN) power semiconductors. GaN chips offer much higher efficiency, faster switching speeds, and reduced energy loss compared to traditional silicon-based semiconductors. This makes them ideal for next-generation power systems that demand high performance with lower energy consumption.

One key element driving Nvidia’s choice is Navitas’ expertise in 800V High Voltage Direct Current (HVDC) power infrastructure. HVDC at 800 volts enables more efficient transmission of electricity over short distances inside data centers, reducing heat generation and minimizing power loss. This allows Nvidia’s Kyber rack-scale systems — designed to support powerful GPUs like Rubin Ultra — to operate at higher power levels (over 1MW) while using less copper wiring, cutting material costs and improving sustainability.

In practical terms, 800V HVDC is a game-changer for data centers where power efficiency and thermal management are critical. By using Navitas’ GaNFast and GeneSiC chips to manage this HVDC power flow, Nvidia can build faster, more powerful AI hardware that also aligns with energy-saving goals, helping reduce carbon footprints.

This combination of cutting-edge semiconductor tech and advanced power delivery makes Navitas uniquely qualified to power the future of AI computing infrastructure. Their role in this collaboration highlights their potential to shape the energy-efficient technologies essential for next-gen data centers — a fast-growing market segment with huge investment and innovation opportunities.

Financial Potential: What This Deal Could Mean for Navitas’ Revenue and Growth

While the exact financial terms of the partnership with Nvidia have not been disclosed, the implications for Navitas Semiconductor’s future revenue are significant. Nvidia’s new Kyber 1MW+ rack-scale systems — which Navitas will help power using its GaNFast™ and GeneSiC™ technologies — are designed to become the backbone of hyperscale AI data centers.

To understand the scale: Analysts estimate that by 2027, AI data centers could consume over 1,000 TWh of electricity annually, more than the power consumption of some entire countries. If Nvidia rolls out even a conservative number of Kyber units globally, the demand for high-efficiency power components like those provided by NVTS could surge exponentially.

Navitas reported $49.9 million in revenue for FY 2023, with projections already pushing toward $70–80 million in 2024. However, if this Nvidia partnership scales as expected, and Navitas components become standard in next-gen data centers, revenues could climb well beyond $200 million annually within the next 2–3 years — a 3–4x potential jump.

Moreover, GaN and SiC (silicon carbide) markets are projected to exceed $10 billion globally by 2030. Navitas, as one of the few pure-play public companies in this space, could capture a significant portion of that market, especially with a flagship client like Nvidia now in its portfolio.

Investor sentiment is already reacting. NVTS shares surged in after-hours trading following the announcement, and analysts may soon revise their price targets. With its stock still under $3, the upside potential is attracting attention from both institutional and retail investors looking for the next breakout semiconductor name.

📈 NVTS Stock Skyrockets: More Than 100% Gain in a Single Day — What’s Next?

Following the game-changing announcement of its partnership with Nvidia, Navitas Semiconductor (NASDAQ: NVTS) stunned investors with a massive single-day surge, climbing more than 100% in value. The stock’s explosive rally reflects the market’s rapid reevaluation of Navitas — from a lesser-known semiconductor name to a potential cornerstone in the future of AI infrastructure.

The jump wasn’t just emotional — it was strategic. As Nvidia prepares to roll out its next-gen 800V Kyber rack systems, Navitas’ high-efficiency GaN and SiC power chips will play a critical role in making this ultra-powerful AI backbone both faster and more energy-efficient. The market saw this not just as a one-off contract, but as a signal that Navitas could become a long-term player in the accelerating data center and AI revolution.

This kind of momentum, especially for a stock trading well under the radar, suggests growing institutional interest and retail investor excitement. If early traction turns into scalable deployments, Navitas could be heading toward a transformative growth phase — one that positions it among the most exciting up-and-coming names in advanced tech.

🌐 The AI Gold Rush: Why the Data Center Boom Is Just Getting Started

Artificial intelligence isn’t just reshaping the software world — it’s completely transforming the infrastructure that powers it. As models grow more complex and demand surges for high-performance computing, data centers are racing to scale faster, cooler, and more efficiently. This is where Navitas steps in.

Nvidia’s next-gen AI platforms, like the Kyber rack-scale systems, require cutting-edge power solutions to handle energy loads far beyond traditional standards. By supporting 800V high-voltage direct current (HVDC) systems, Navitas enables a more efficient flow of electricity with significantly reduced energy loss — crucial for powering dense, AI-optimized server racks without overheating or ballooning costs.

This shift toward HVDC architecture is becoming a foundational upgrade in next-gen data centers, especially as hyperscalers like AWS, Google Cloud, and Microsoft Azure invest billions into AI infrastructure. That means NVTS isn’t just landing a deal with Nvidia — it’s aligning with an entire industry trend. If their chips prove scalable and reliable, they could become a key supplier across the broader AI ecosystem.

In short: Navitas is positioning itself at the very heart of the AI infrastructure wave — a wave that’s expected to grow into a multi-trillion-dollar global market over the next decade.

A Small Name With a Giant Opportunity

Navitas may not yet be a household name, but this week’s announcement places it firmly in the spotlight. Partnering with Nvidia isn’t just a short-term win — it’s a long-term validation of Navitas’ technology, leadership, and relevance in the rapidly evolving world of AI infrastructure.

With demand for faster, greener, and more efficient power solutions skyrocketing, Navitas has found itself in a high-growth lane. If it continues to deliver on performance and scalability, NVTS could transform from an under-the-radar chipmaker into a critical enabler of the next wave of AI computing.

For investors, this is no longer just a speculative penny stock — it’s a company with real-world utility, major partnerships, and a front-row seat in one of the most explosive tech revolutions of our time.

Keep your eyes on NVTS. This story is just getting started.