The connection between NIO and McLaren is not a direct, traditional business partnership in the sense of a joint venture or an immediate co-developed product line. Instead, it’s a strategic alignment facilitated by CYVN Holdings, an Abu Dhabi-based advanced mobility investment vehicle. CYVN Holdings is a significant shareholder in both NIO and McLaren.

The Foundation of the Connection: CYVN Holdings’ Investments

- CYVN Holdings’ Investment in NIO: CYVN Holdings became NIO’s largest single shareholder in 2023, increasing its stake to approximately 20.1% through investments totaling around $3.3 billion (as of December 2023). While CYVN is the largest single shareholder, William Li (NIO’s founder) remains the largest single voting shareholder and actual controller.

- CYVN Holdings’ Acquisition of McLaren: In April 2025, CYVN Holdings completed its acquisition of McLaren Automotive’s business and a non-controlling stake in McLaren’s Racing business. This led to the formation of a new entity, McLaren Group Holdings Ltd., which consolidates McLaren Automotive and British luxury start-up Forseven (another CYVN subsidiary).

Sources: CYVN Holdings completes McLaren transaction & consolidates McLaren Automotive and British luxury start-up Forseven under new group (McLaren Newsroom, April 3, 2025); NIO’s major shareholder acquires McLaren’s sports car business (Futubull, December 15, 2024)

The Mechanism of Collaboration: Technology Sharing via Forseven

The crucial link for technology sharing between NIO and McLaren comes through Forseven.

- NIO’s Technology Licensing to Forseven: In February 2025, NIO announced that its subsidiary, NIO Automobile Technology (Anhui) Co., had entered into a technology licensing agreement with Forseven. Under this agreement, NIO grants Forseven a non-exclusive and non-transferable global license to use certain existing and future technical information, technical solutions, software, and intellectual property related to or contained in NIO’s intelligent electric vehicle platform. This explicitly allows Forseven to use NIO’s technology for “research and development, manufacturing, sales, import, and export of models sold or promoted under the Forseven brand.”

- McLaren’s Access to NIO Technology: With the consolidation of McLaren Automotive and Forseven under the new McLaren Group Holdings, and with CYVN Holdings being a common investor in both NIO and the newly formed McLaren Group, McLaren is now positioned to benefit from CYVN’s strategic investment in NIO to gain access to visionary technologies and electrification.

Sources: McLaren could utilize Nio technology for electric supercars (Car News China, April 4, 2025); CYVN Holdings completes McLaren transaction & consolidates McLaren Automotive and British luxury start-up Forseven under new group (McLaren Newsroom, April 3, 2025)

Specific Areas of Potential Collaboration and Impact for NIO

The reports indicate several key areas where NIO’s technology could significantly impact McLaren’s future:

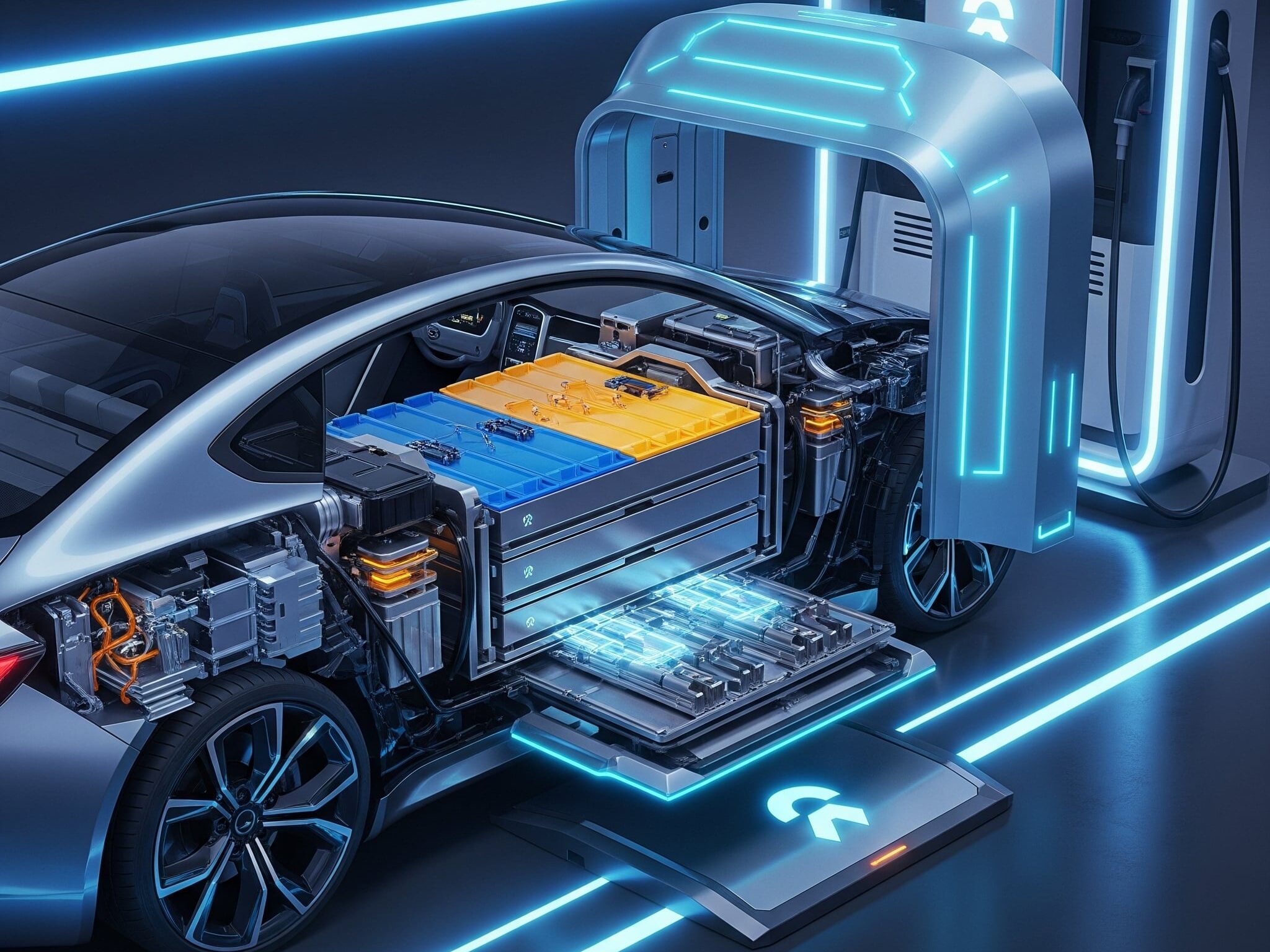

1. Battery Technology and Development:

- NIO to Supply Batteries to McLaren (Reported): A recent report (June 6, 2025) suggests that NIO is set to develop and supply power batteries for McLaren’s hybrid models.

- 4680 Large Cylindrical Cells: The battery pack will reportedly be based on NIO’s in-house developed 4680 large cylindrical battery cells, with small-scale production expected to begin next year (2026). This is significant as 4680 cells are known for their energy density and thermal efficiency, often associated with Tesla’s battery strategy.

- Restart of R&D for 46105 Cells and 120-kWh Pack: The collaboration is also expected to restart NIO’s R&D on the 46105 large cylindrical battery cell and a 120-kWh battery pack, originally planned for the NIO ET9 but not materialized. This could represent a substantial advancement for NIO’s battery tech.

- Initial 10 kWh Pack for Hybrids: The first iteration is expected to be a ~10 kWh battery pack for McLaren’s hybrid models, with a sample battery pack slated for delivery to McLaren next month (July 2025). Mass production is scheduled for next year (2026).

- Common Investor Driven: This battery collaboration is primarily driven by the common investor, CYVN Holdings.

Source: Nio to supply batteries to McLaren, report says (CnEVPost, June 6, 2025)

2. EV Platform, Software, and AI-Driven Dynamics:

- McLaren could leverage NIO’s advanced software, hardware, and electrification technologies from its intelligent EV platform.

- This could lead to the development of innovative products and services in the automotive sector, including new product categories for McLaren.

- NIO’s expertise in AI-based vehicle dynamics could revolutionize how McLaren supercars drive, making them more connected and enhancing the driving experience without sacrificing performance.

- The potential for NIO’s battery swapping technology in future McLaren models, while not explicitly confirmed, remains a speculative possibility given NIO’s core differentiator.

Sources: McLaren could utilize Nio technology for electric supercars (Car News China, April 4, 2025); New Electric McLaren Announcement Expected Following Merger With EV Luxury Startup (Topspeed, April 7, 2025)

3. Diversification into New Product Categories for McLaren:

- The merger and access to NIO’s EV know-how could facilitate McLaren’s expansion into new vehicle categories, such as luxury SUVs and sports sedans, following the trend set by Ferrari, Lamborghini, and Porsche. This would broaden McLaren’s market reach and revenue streams.

Source: Nio technology in future McLaren cars (Brochureshub, June 1, 2025)

Could This Be Big for NIO?

Yes, this absolutely has the potential to be very big for NIO. Here’s why:

1. Validation and Brand Prestige:

- Global Recognition: A partnership, even indirect, with a storied luxury supercar brand like McLaren provides immense validation for NIO’s technology. It signals that NIO’s EV platform, battery tech, and software are robust enough for high-performance, high-end applications.

- Technological Credibility: This move helps establish NIO as a serious, world-class EV technology provider, not just a car manufacturer. It could elevate the perception of Chinese EV innovation on a global scale.

- “EV Tech Provider” Status: If NIO’s technology is adopted by McLaren, it could pave the way for other luxury or performance brands to consider NIO as a potential tech partner, expanding its business model beyond just selling its own branded vehicles.

2. Revenue Streams and Scale:

- Technology Licensing Fees: The licensing agreement with Forseven, and implicitly McLaren, could generate significant revenue for NIO, diversifying its income away from just vehicle sales.

- Battery Supply Contracts: The reported battery supply deal for McLaren’s hybrid models could be the first of many, providing a steady revenue stream and increasing the utilization of NIO’s battery manufacturing capabilities (especially if they restart larger cell production).

- Increased R&D Efficiency: Collaborating on high-performance EV components with McLaren could accelerate NIO’s own R&D efforts, leading to innovations that can be applied to its own consumer vehicles (NIO, ONVO, FIREFLY brands).

3. Market Sentiment and Investment:

- Investor Confidence: This strategic alignment, driven by a major investor, can significantly boost investor confidence in NIO, potentially leading to a rebound in its stock value. It demonstrates a clear path to leveraging its technological assets for broader industry impact.

- Competitive Edge: In a fiercely competitive EV market, this unique arrangement with McLaren provides NIO with a distinct advantage and a compelling narrative for its technological prowess.

4. Future Potential:

- Shared Synergies: The common ownership by CYVN Holdings fosters a natural environment for deeper collaboration in the future, possibly extending to shared platforms, components, or even manufacturing insights.

- Global Expansion: While McLaren is not a volume player, its global prestige can open doors for NIO’s technology to be recognized and adopted in various international markets, indirectly supporting NIO’s own expansion efforts.

Numbers and Scope

- CYVN Holdings’ Investment in NIO: ~$3.3 billion (as of Dec 2023), resulting in a ~20.1% stake.

- Battery Supply: Reported initial battery packs for McLaren’s hybrid models are ~10 kWh. Small-scale production to begin in 2026. The full scale of battery supply or technology licensing fees hasn’t been disclosed, but the potential is for substantial, recurring revenue.

- McLaren’s EV Transition: McLaren has been making losses and is seeking partnerships to fund new model development and electrify its lineup. Access to NIO’s technology is critical for McLaren to stay competitive in the evolving luxury performance vehicle market.

Risks and Challenges

Despite the immense potential, some risks remain:

- Execution Risk: Successfully integrating NIO’s technology into McLaren’s unique, high-performance vehicles requires flawless execution and engineering.

- Brand Dilution (for McLaren): McLaren will need to ensure that incorporating external technology doesn’t dilute its core brand identity of bespoke, high-performance vehicles.

- Profitability of NIO: While this collaboration could provide revenue, NIO still needs to demonstrate a clear path to overall profitability for its core vehicle manufacturing business.

- Global Economic and Geopolitical Factors: Broader trade tensions or economic slowdowns could still impact the automotive sector.

In summary, the NIO-McLaren connection, facilitated by CYVN Holdings, is not a typical partnership but a powerful strategic alignment. It positions NIO as a significant player in the global EV technology landscape, offering its advanced battery and platform solutions to a prestigious luxury brand. This could be a game-changer for NIO, providing crucial validation, new revenue streams, and a strong tailwind for its long-term growth and profitability, moving beyond just being an EV manufacturer to an EV tech provider.